Earlier, people had to visit the excise department office for application of permits, but they can now directly take their requests online.

This Monday the excise department brought private party organisers in Gurgaon some very good news. From April 1, they will be able to apply online for one-day liquor permits for home parties or private venues.

Earlier, people had to visit the department office for application of permits, but they can now directly take their requests online.

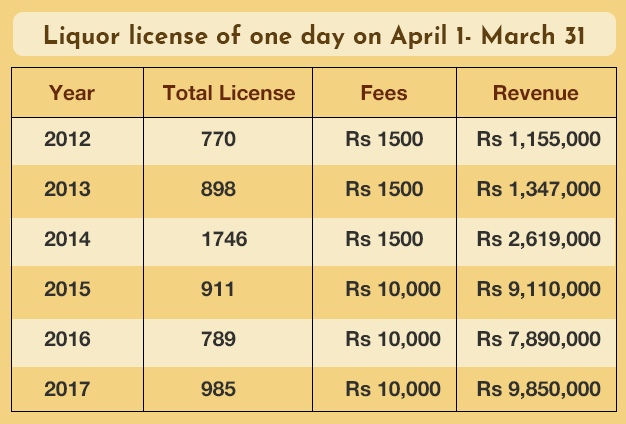

The number of one-day liquor licences had dropped drastically in 2015, when the excise department had raised the licence fee from Rs 1,500 to Rs 10,000 per venue. However, last year, with the Supreme Court issuing a nation-wide ban on sale of liquor within 500 m of national and state highways — and Cyber Hub, Gurgaon’s prime watering hole taking a bad hit — most people had no option but to stay indoors for their drink, and the demand for one-day liquor licences increased again.

Data shows that last year, the excise department issued 985 one-day liquor licenses, as compared to the 798 in 2016.

“Since the liquor licence fees increased in 2015 and more outlets serving liquor came up, people started preferring to party at restaurants, pub and bars. But when the sale of liquor was banned within 500 m of highways, more people started acquiring licences again to party at home or at private venues,” said HC Dahiya, deputy excise and taxation commissioner, Gurgaon (West).

If you are one of those who like to party at home or book private venues, here are a few things to keep in mind: